Artificial Intelligence has moved far beyond being a business buzzword. In Canada’s fast-changing financial and tax environment, AI is becoming a practical tool for improving accuracy and efficiency in tax planning.

Browsing CategoryBlogs

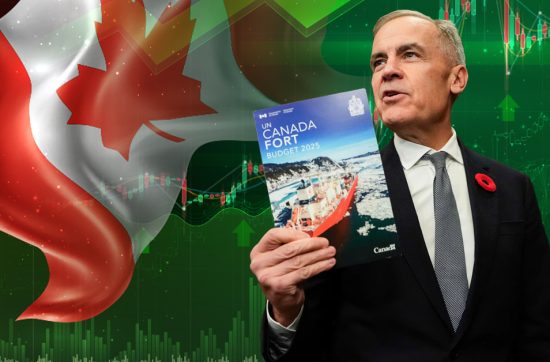

Western Canada Businesses and Budget 2025: What to Prepare for

As Alberta-based businesses continue to discern rapidly shifting economic and regulatory terrain, the federal Budget 2025 brings both opportunities and imperatives for strategic action.

Implementation Variables That Determine SoX Compliance Outcomes

The Sarbanes-Oxley Act of 2002 (SOX) remains one of the most significant pieces of legislation governing corporate governance, financial reporting, and internal control.

ISO 14001 – Implementing, Testing and Certification

The ISO 14001 has become the international standard of Environmental Management Systems (EMS) in an age where sustainability is no longer a choice.

ERP Platforms for Small Businesses and Their Advantages Over Conventional Accounting Systems

Small and mid-sized businesses (SMBs) in Canada are increasingly outgrowing the limits of conventional accounting software such as QuickBooks and Xero.

The CFO Challenge: Navigating Reporting Obligations for Canadian Public Issuers

The position of Chief Financial Officer of a Canadian public issuer is one that is subject to a very unusual set of liabilities. In contrast to their private-sector counterparts, CFOs operating in the public markets have compressed regulatory timeframes,

Change Management as Part of Finance Transformation: Strategies for Effective Implementation and Business Success

Finance transformation is no longer optional it is a business imperative. Driven by evolving regulatory requirements, technological advancements, and increasing demands for efficiency and insight, organizations

Buyer-Side Due Diligence: Key Steps and Critical Considerations

Buyer-side due diligence is not a mere formality as far as acquisition is concerned. It is the most critical of all protections to certify value, risk discovery, and plan to integrate.